This is the second post of 3 presenting the argument against introducing 5G-SA.

There’s an old adage that businesses spend money for one of three reasons:

- To Save Money (Which I covered yesterday)

- To make more Money (This post, congratulations, you’re reading it!)

- Because they have to (Regulatory compliance, insurance, taxes, etc) – That’s the next post

So let’s look at SA in this context.

5G-SA can drive new revenue streams

We (as an industry) suck at this.

Last year on the Telecoms.com podcast, Scott Bicheno made the point that if operators took all the money they’d gambled (and lost) on trying to play in the sports rights, involvement in media companies, building their own streaming apps, attempts at bundling other utilities, digital identity, etc, and just left the cash in the bank and just operated the network, they’d be better off.

Uber, Spotify, “OTTs”, etc, utilize MNOs to enable their services, but operators don’t see this extra revenue.

While some operators may talk of “fair share” the truth is, these companies add value to our product (connectivity) which as an industry, we’ve failed to add ourselves.

Last year at MWC we saw vendors were still beating the drum about 5G being critical for the “Metaverse”, just weeks before Meta announced they were moving away from the Metaverse.

Today the only device getting any attention from consumers is Apple’s Vision Pro, a very pricey, currently niche offering, which has no SIM card or cellular connectivity.

If the Metaverse does turn out to be a cash cow, it is unlikely the telecommunications industry will be the ones milking it.

Claim: Customers are willing to pay more for 5G-SA

This myth seems to be fairly persistent, but with minimal data to support this claim.

While BSS vendors talk about “5G Monetization”, the truth is, people use their MNO to provide them connectivity. If the coverage is adequate, and the speed enough to do what they need to do, few would be willing to pay any additional cash each month to see higher numbers on a speedtest result (enabled by 5G-NSA) and even fewer would pay extra cash for, well, whatever those features only enabled by 5G-Standalone are?

With most consumers now also holding onto their mobile devices for longer periods of time, and with interest rates reining in consumer spending across the board, we are seeing the rise of a more cost conscious consumer than ever before. If we want to see higher ARPUs, we need to give the consumer a compelling reason to care and spend their cash, beyond a speed test result.

We talk a little about APIs lower down in the post.

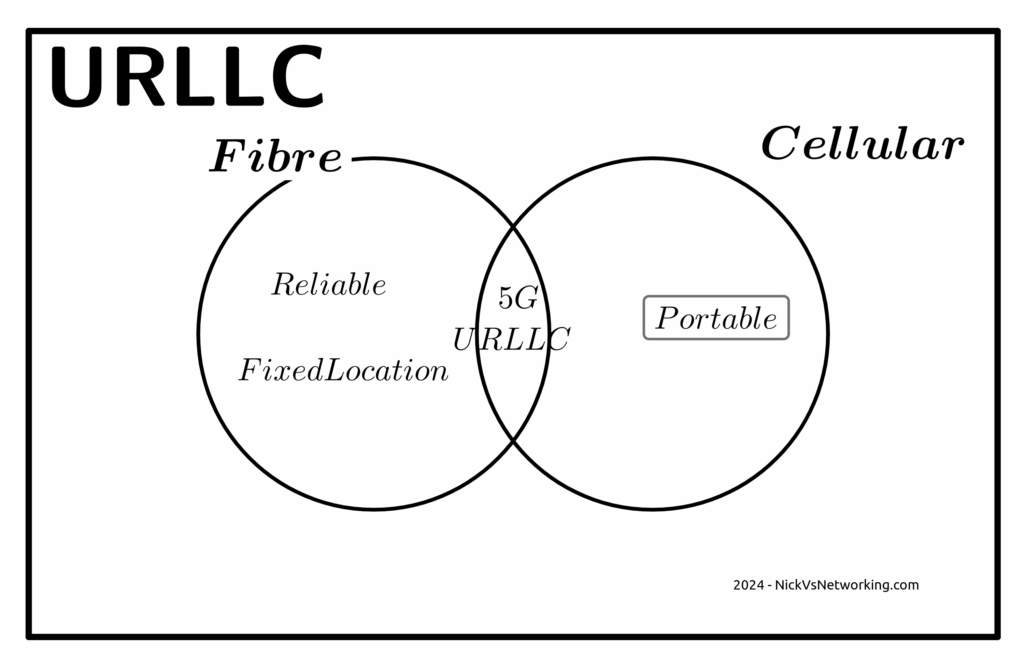

Claim: Users want Ultra-Low Latency / High Reliability Comms that only 5G-SA delivers

Wanting to offer a product to the market, is not the same as the market wanting a product to consume.

Telecom operators want customers to want these services, but customer take up rates tell a different story. For a product like this to be viable, it must have a wide enough addressable market to justify the investment.

Reliability

The URLCC standards focus on preventing packet loss, but the world has moved on from needing zero packet loss.

The telecom industry has a habit of deciding what customers want without actually listening.

When a customer talks about wanting “reliable” comms, they aren’t saying they want zero packet loss, but rather fewer dropouts or service flaps.

For us to give the customer what they are actually asking for involves us expanding RAN footprint and adding transmission diversity, not 5G-SA.

The “protocols of the internet” (TCP/IP) have been around for more than 50 years now.

These protocols have always flowed over transport links with varied reliability and levels of packet loss.

Thanks to these error correction and retransmission techniques built into these protocols, a lost packet will not interrupt the stream. If your nuclear command and control network were carried over TCP/IP over the public internet (please don’t do this), a missing packet won’t lead to worldwide annihilation, but rather the sender will see the receiver never acknowledged the receipt of the packet at the other end, and resend it, end of.

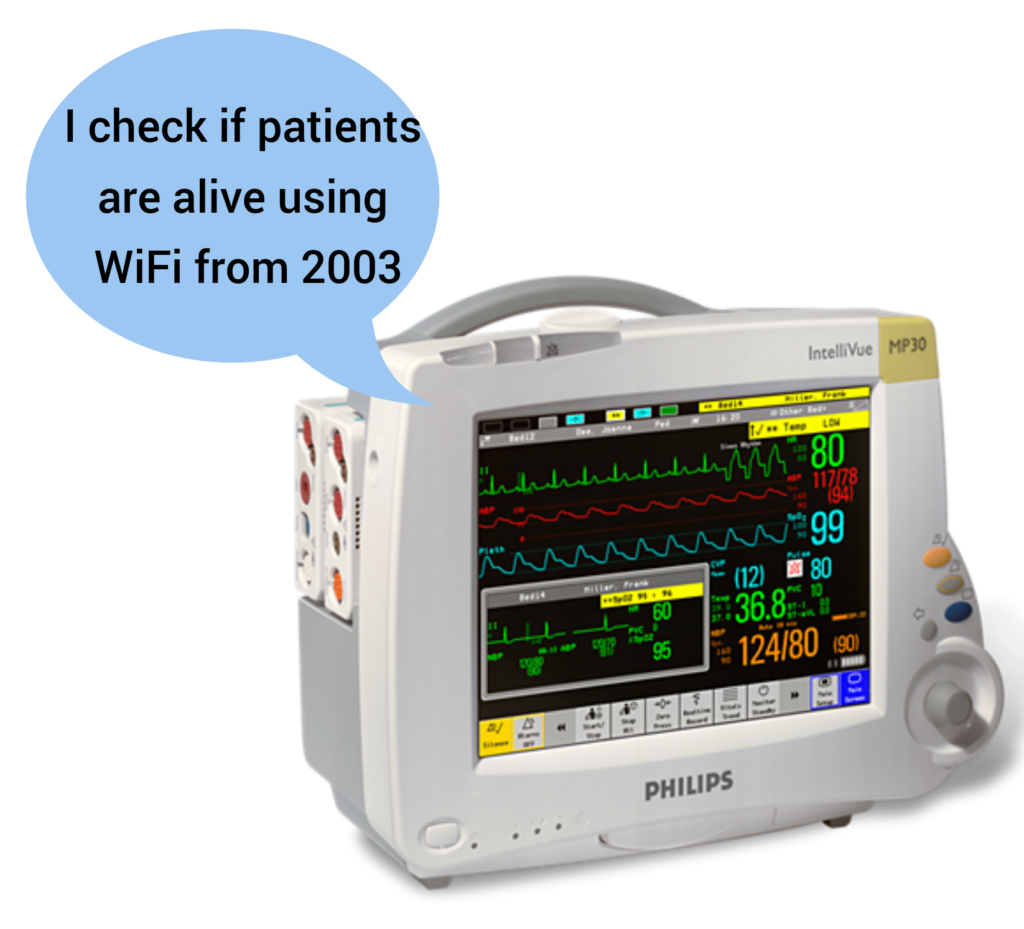

If you walk into a hospital today, you’ll find patient monitoring devices, tracking the vital signs for patients and alerting hospital staff if a patient’s vital signs change. It is hard to think of more important services for reliability than this.

And yet they use WiFi, and have done for a long time, if a packet is lost on WiFi (as happens regularly) it’s just retransmitted and the end user never knows.

Autonomous cars are unlikely to ever rely on a 5G connection to operate, for the simple reason that coverage will never be 100%. If your car stops because you’re in a not-spot, you won’t be a happy customer. While plenty of cars have cellular modems in them, that are used to upload telemetry data back to the manufacturer, but not to drive the car.

One example of wireless controlled vehicles in the wild is autonomous haul trucks in mines. Historically, these have used WiFi for their comms. Mine sites are often a good fit for Private LTE, but there’s nothing inherent in the 5G Standalone standard that means it’s the only tool for the job here.

Slicing

Slicing is available in LTE (4G), with an architecture designed to allow access to others. It failed to gain traction, but is in networks today.

What is different this time?

Low Latency

The RAN a piece of the latency puzzle here, but it is just one piece of the puzzle.

If we look at the flow a packet takes from the user’s device to the server they want to talk to we’ve got:

- Time it takes the UE to craft the packet

- Time it takes for the packet to be transmitted over the air to the base station

- Time it takes for the packet to get through the RAN transmission network to the core

- Time it takes the packet to traverse the packet core

- Time it takes for the packet to get out to transit/peering

- Time it takes to get the packet from the edge of the operators network to the edge of the network hosting the server

- Time it takes the packet through the network the server is on

- Time it takes the server to process the request

The “low latency” bit of the 5G puzzle only involves the two elements in bold.

If you’ve got to get from point A to point B along a series of roads, and the speed limit on two of the roads you traverse (short sections already) is increased. The overall travel time is not drastically reduced.

I’m lucky, I have access to a well kitted out lab which allows me to put all of these latency figures to the test and provide side by side metrics. If this is of interest to anyone, let me know. Otherwise in the meantime you’ll just have to accept some conjecture and opinion.

You could rebut this talking about Edge Compute, and having the datacenter at the base of the tower, but for a number of fairly well documented reasons, I think this is unlikely to attract widespread deployment in established carrier networks, and Intel’s recent yearly earning specifically called this out.

Claim: Customers want APIs and these needs 5G SA

Companies like Twilio have made it easy to interact with the carrier network via their APIs, but yet again, it’s these companies producing the additional value on a service operated by the MNOs.

My coffee machine does not have an API, and I’m OK with this because I don’t have a want or need to interact with it programatically.

By far, the most common APIs used by businesses involving telco markets are APIs to enable sending an SMS to a user.

These have been around for a long time, and the A2P market is pretty well established, and the good news is, operators already get a chunk of this pie, by charging for the SMS.

Imagine a company that makes medical booking software. They’re a tech company, so they want their stack to work anywhere in the world, and they want to be able to send reminder SMS to end users.

They could get an account manager with each of the telcos in each of the markets they work in, onboard and integrate the arcane complexities of each operators wholesale SMS system, or they could use Twilio or a similar service, which gives them global reach.

Often the cost of services like Twilio are cheaper than working directly with the carriers in each market, and even if it is marginally more expensive, the cost savings by not having to deal with dozens of carriers or integrate into dozens of systems, far outweighs this.

GSMA’s OpenGateway Initiative has sought to rectify this, but it lacks support for the use case we just discussed.

While it’s a great idea, in the context of 5G Standalone and APIs, it’s worth noting that none of the use cases in OpenGateway require 5G Standalone (Except possibly Edge discovery, but it is debatable).

Even Slicing existed before in LTE.

Critically, from a developer experience perspective:

I can sign up to services like Twilio without a credit card, and start using the service right away, with examples in my programming language of choice, the developer user experience is fantastic.

Jump on the OpenGateway website today and see if you can even find a way to sign up to use the service?

Claim: Fixed Wireless works best with 5G-SA

Of all the touted use cases and applications for 5G, Fixed Wireless (FWA) has been the most successful.

The great thing about FWA on Cellular networks is you can use the same infrastructure you use for your mobile customers, and then sell excess capacity in the network to deliver Fixed Wireless Access services, better utilizing an asset (great!).

But again, this does not require Standalone 5G. If you deploy your FWA network using 5G SA, then you won’t be able to sweat that same asset for both mobile subscribers and FWA subscribers.

Today at least, very few handsets short of this generation of flagship phones, supports 5G SA. Even the phones sold as supporting 5G over the past few years, are almost all only supporting 5G-NSA, so if you rolled out your FWA network as Standalone, you can’t better utilize the asset by sharing with your existing LTE/5G-NSA customers.

Claim: The Killer App is coming for 5G and it needs 5G SA

This space is reserved for the killer app that requires 5G Standalone.

Whenever that comes?

Anyone?

I’m not paying to build a marina berth for my mega yacht, mostly because I don’t have one. Ditto this.

Could you explain to everyone on an investor call that you’re investing in something where the vessel of the payoff isn’t even known to exist? Telecom is “blue chip”, hardly speculative.

The Future for Revenue Growth?

Maybe there isn’t one.

I know it’s an unthinkable thought for a lot of operators, but let’s look at it rationally; in the developed world, everyone who wants a mobile service already has one.

This leaves operators with two options; gaining market share from their competitors and selling more/higher priced services to existing customers.

You don’t steal away customers from other operators by offering a higher priced product, and with reduced consumer spending people aren’t queuing up to spend more each month.

But there is a silver lining, if you can’t grow revenues, you can still shrink expenditure, which in the end still gets the same result at the end of the quarter – More cash.

Simplify your operations, focus on what you do really well (mobile services), the whole 80/20 rule, get better at self service, all that guff.

There’s no shortage of pain points for consumers telecom operators could address, to make the customer experience better, but few that include the word Slicing.

One of the biggest challenges we have faced deploying 5G SA has been getting workable configurations with different CPE/UEs and our 5G SIMs. OEM support for 5G SA is still a little patchy – but coninues to improve – and with much time/effort we have made great inroads into solving most of the obvious gotchas associated with the complex interactions between SIM and host device.

Once the user end is sorted (not trivial) – 5G SA presents a very cost effective and flexible way of providing high performance and flexible service – on an affordable single band radio. We have deployed infrastructure (in rural Wales) capable of providing circa 1.4 Gbps down for FWA, but with the same radio, operating with a much narrower 5 MHz waveform we have demonstrate how large areas of sparsely populated Not Spot can be covered with a very workable service to mobile devices.

We are great fans and supporters of Open 6GS, which we use as our ‘Front End Core’ for these 5G SA deployments – which, after investment of a certain amount of time and effort provides a flexible and cost effective solution for the provision of services.

It is a shame that we could not get you over to join us at MWC this year Nick – I hope that MWC 2025 will be the chance for us all to get together with the ‘Heroes of Mobile Open Source’ to plan how we are changing the World of Mobile Communications!

Oh – and the one scenario for URLLC that I think that we *ARE* going to see driving the deployment of 5G SA is for management of electrical power.

Smart Metering and Smart Power Management are areas of huge interest within the Power Generation and Transmission industry. With widespread installation of large amounts of domestic battery power storage, the opportunity to use this resource as a way of dealing with peak variations in demand is becoming more important. At present, the power generation industry maintain a generating capabilty well above the average demand, in order to be able to cope with peak surges in demand across the power grid. This extra capacity currently sits at around 25-30% of average demand – and keeping this huge amount of surplus capacity online costs a considerable amount of money.

By dynamically changing the infeed price for power, typically every half cycle (100 ties a second here is the EU), prices can reflect demand. When peak demand hits the grid, the prices increase – and this in turn can trigger multiple battery storage units to start supplying energy to the grid. Similarly, when demand is low, prices drop, thereby prompting domestic batteries to take power from the grid to recharge. The net result of this mechanism is that the amount of contingency power generation required to keep the power grid running can be hugely reduced.

In order to facilitate this, every smart domestic power storage unit has to be constantly be fed updated pricing info over a very relible and low latency mechanism; 5G SA is an extremely useful way of doing this!

If you check out the current range of 5QIs specified by 3GPP for use within 5G systems, you will not surprisingly find the those for power distribution are the most demanding low latency specifications – and are offered extremely high priority.