The other day I got an SMS from my bank, one of the big 4 Australian Banks.

BANKNAME Alert: Block placed on card ending in XXXX, for suspicious transaction at ‘THING NICK PURCHASED ONLINE’ for $29.00 at 13:56. If genuine, reply ‘Yes’. If Fraud, reply ‘No’.

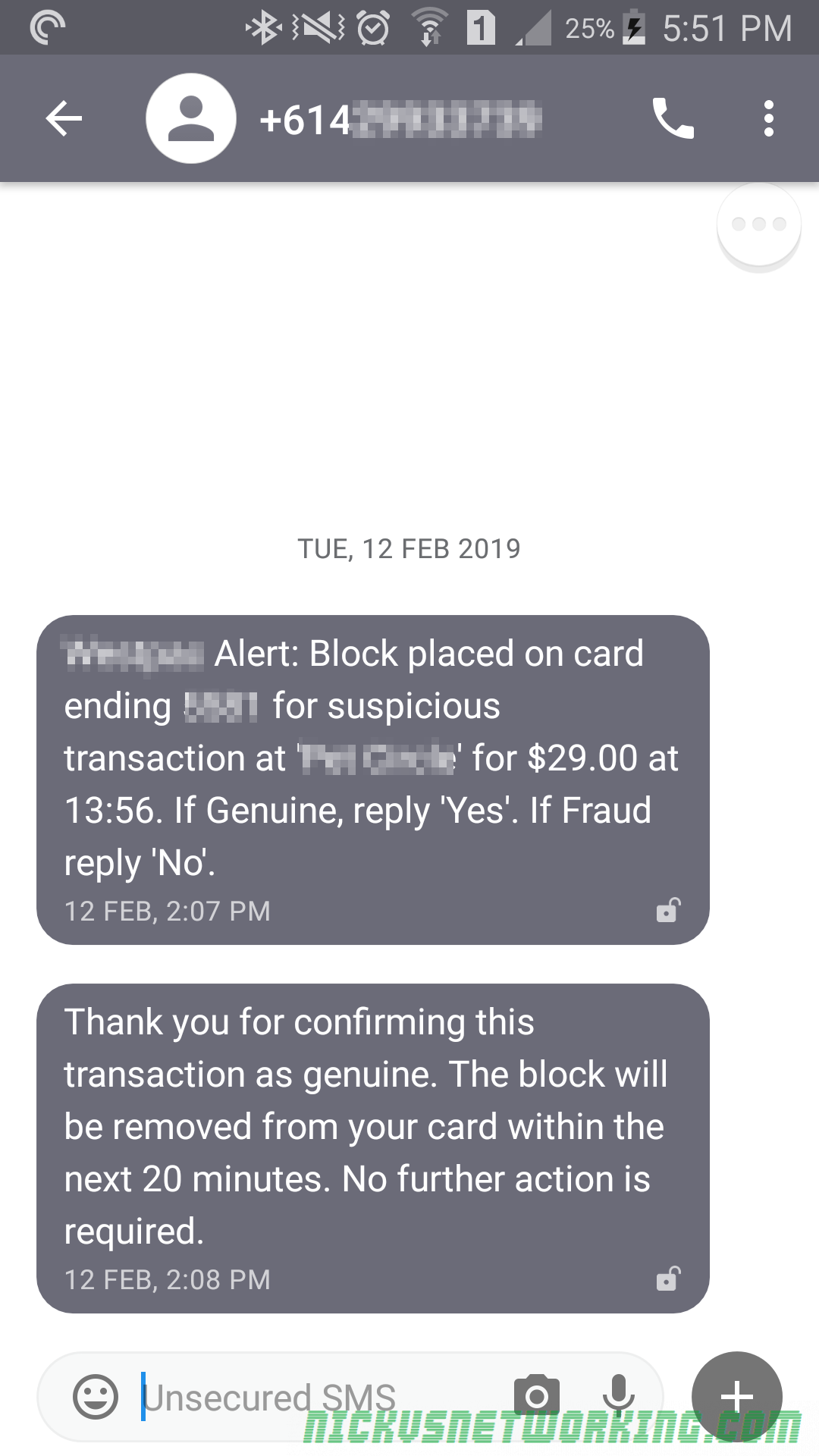

SMS from bank

They’d detected possible fraud on my card, and were asking me to confirm if it was me or not by texting back.

That is my correct card number, and as it happens I had made an online purchase that was what it was querying.

I was already at my computer, so out of curiosity, opened the SMS Gateway I use, and set the caller ID to be my mobile number (Because spoofing Caller ID is trivial) and replied to the number the bank sent me the SMS from.

My phone beeped again:

Thank you for confirming this transaction is genuine. The block will be removed from your card within the next 20 minutes. No further action is required.

SMS from Bank

So what’s the issue here?

The issue is if someone were to steal your card details, and know your mobile number, they could just keep texting the bank’s verification line the word “yes” from an SMS gateway spoofing your Caller ID, the bank won’t block it.

No system is foolproof, but it seems a bit short sighted by this bank.

Texting back a code would be a better solution, because it would allow you to verify the person texting received the original SMS, or cycling the caller IDs from a big pool would decrease the likelihood of this working

Do you know if the banks are using a pool of numbers for reply? In terms of mitigating risk it’s definately not a secure solution however the actor would need to know the banks reply numbers. But definately insecure from any angle, especially from a bank.

Of the two messages I’ve received both have been from the same number.

Not to say that’s the only one they have though.