There’s always a lot of talk and opinion about the technologies the NBN employs, it’s effectiveness, etc.

I’ve made a conscious decision to steer clear of opinion in this blog, but there’s often talk and blame shifting between NBNco and RSPs, so I thought I’d cover how the business model works.

Because of this I thought it’d be interesting to write about how the network actually works between carriers (RSPs) and NBNco.

Physical Structure

Last Mile

The last mile in US terms, CAN in Australian Telecom lingo, is connecting the subscriber edge to the network.

NBNCo employs a few different technologies for this, depending on a number of factors;

- Fiber to the Premises (Original standard – End to end fibre)

- Fiber to the Node (Later addition) (Street based DLAMs for VDSL / DPUs)

- Fixed Wireless (Fixed LTE)

- Fiber to the Curb (Mini DSLAM powered by Modem shared between 4 subscribers and fed by fiber)

- HFC – Reusing the former Optus Coax network (previously used for cable internet & pay TV)

- Skymuster (Satellite service)

NBNco Backhaul

All these last mile services get consolidated and eventually end up at a local PoI – Point of Interconnect, (typically called a POP if you’re any other telco).

These are typically hosted inside exchanges, but not every exchange is an NBNco PoI, if it’s not it uses NBN Backhaul to get to the nearest PoI.

NBNco currently operates 121 PoI sites.

NBNco don’t exclusively use TEBA sites, some are hosted in NBNco “Depots”, there’s currently 10 sites not in TEBA footprints.

At the PoI

Retail Service Providers (RSPs) have to have racks inside the PoI locations, and essentially setup layer 2 cross-connects to the NBNco racks.

Once the traffic is on the RSP network, it’s the RSP’s responsibility to carry it where it needs to go, via their own network / backhaul.

Billing and Metering

Of course, if NBNco is handing off the pipes of customer traffic off to each RSP they need a way to charge the RSPs for this, this is handled by two elements – CVCs equating to the bandwidth at the PoI and AVCs equating to a fixed standing charge per connection monthly.

CVC – Connectivity Virtual Circuit

At the PoI the connection between the NBNco rack and the RSP rack is metered over a CVC – Connectivity Virtual Circuit.

This is shared across all users of that RSP at that PoI.

Let’s say I’m an RSP and I’ve purchased a 1Mbps CVC shared across my 1,000 customers at that PoI, the customers aren’t going to have a good experience.

Of course, CVC bandwidth isn’t free, previously NBNco charged on average $15.25/Mbps.

This had the effect of ensuring each RSP had just enough CVC bandwidth for their customers, but this led to some customers having a poor experience on switching to NBNco as they found their speeds dropped due to not enough CVC bandwidth at the PoI for that RSP.

In June 2017 NBNco announced a change to the pricing structure to try and encourage RSPs to buy more CVC bandwidth to ensure customers speeds weren’t bottlenecked at the CVC.

The new pricing structure makes it more financially attractive to buy more CVC bandwidth based on how many active connections (AVCs) an RSP has in place.

NBNco now charges $17.50 per symmetrical Mbps for each traffic class. (More on traffic classes later)

This means at each PoI the RSP must have a pool of CVC bandwidth large enough to meet the needs of all the customers connections (AVCs) bandwidth needs at that PoI.

AVC – Access Virtual Circuit

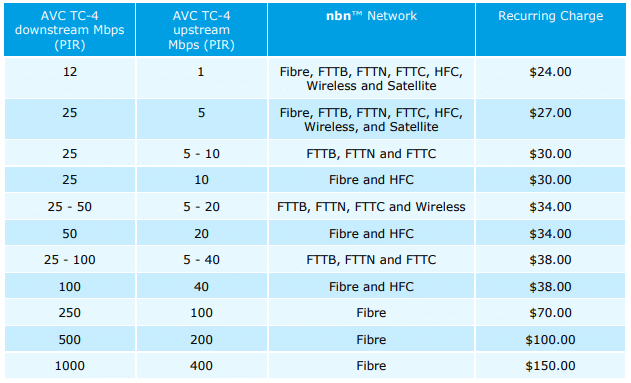

NBNco charges AVC fees based on the speed tier the end user will have and the traffic class (QoS) the service has applied.

(This speed tier is regardless of if the RSP has the CVC bandwidth to support this)

Introducing NNIs

NBNco acknolged in Jul 2018 that for some carriers (RSPs) having presence in 121 sites puts up a large barrier to entry.

To counteract this they introduced Network-Network Interface (NNI).

Imagine you’re operating an RSP with a footprint in capital cities and PoI / CVCs in populated areas, you can’t serve customers in remote areas without having a presence at their local NBNco PoI location and buying CVC bandwidth for that location – It just wouldn’t stack up financially.

NBNco introduced the NNI product to essentially backhaul the traffic from these customers to the nearest PoI their RSP is at and share the CVC bandwidth at that PoI.